Strategic Pre-Transaction Value Creation: Why a Growth Agency Must Precede the Investment Banker

The Valuation Maximization Imperative

The consideration of a significant transaction—whether a capital raise or a sale—forces middle-market leaders to confront a critical decision regarding external expertise. The prevalent, yet fiscally detrimental, misconception is that the Investment Banker is the requisite first partner. In reality, most firms introduce the banker prematurely and engage a Strategic Marketing Partner (Agency) too late.

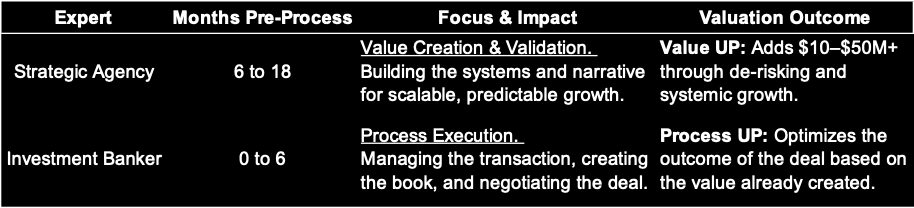

The banker's remit is primarily process execution and selling the asset as it currently stands. Conversely, a specialized Agency's function is pre-transaction value engineering—the systematic enhancement of the company's enterprise value well in advance of the sale process.

This strategic sequencing represents the difference between accepting an acceptable offer and achieving a maximal valuation, often translating into a $10 million to $50 million+ differential in ultimate enterprise valuation.

Strategic Pre-Transaction Value Creation: Why a Growth Agency Must Precede the Investment Banker

The Valuation Maximization Imperative

The consideration of a significant transaction—whether a capital raise or a sale—forces middle-market leaders to confront a critical decision regarding external expertise. The prevalent, yet fiscally detrimental, misconception is that the Investment Banker is the requisite first partner. In reality, most firms introduce the banker prematurely and engage a Strategic Marketing Partner (Agency) too late.

The banker's remit is primarily process execution and selling the asset as it currently stands. Conversely, a specialized Agency's function is pre-transaction value engineering—the systematic enhancement of the company's enterprise value well in advance of the sale process.

This strategic sequencing represents the difference between accepting an acceptable offer and achieving a maximal valuation, often translating into a $10 million to $50 million+ differential in ultimate enterprise valuation.

The Economic Cost of Premature Banking: The Valuation Discount

Engaging an investment banker without adequate strategic preparation forces them to market the status quo. Buyers are inherently risk-averse; they seek clarity on growth drivers, market viability, and customer acquisition efficiency. When this clarity is absent, buyers systematically apply a Valuation Discount.

The postponement of strategic agency input directly contributes to this discount by introducing critical uncertainties:

Weakened Investment Thesis: The absence of a clear, compelling, and validated growth narrative introduces ambiguity, which buyers directly translate into risk and a lower multiple.

Undocumented Customer Economics: Metrics like Total Addressable Market (TAM), Customer Acquisition Cost (CAC), and Lifetime Value (LTV) are poorly defined or sub-optimized, eroding confidence in future recurring revenue.

Concentration Risk: Reliance on unsegmented markets or a small set of customers creates revenue concentration risk, a structural issue the banker can only explain, not mitigate.

This condition aligns with observed M&A trends, as articulated by PwC:

"Lower-quality assets continue to struggle to attract interest, and we are seeing that sale processes for such companies are being extended and sometimes ended." The definition of a "high-quality asset" hinges fundamentally on the predictability and defensibility of its growth—the strategic mandate of the Agency.

The Strategic Agency Mandate: Engineering Defensible Value

A strategic Agency functions as an external Chief Growth Officer (CGO) or fractional CMO team, transcending basic tactical marketing to focus on structural growth systems. Their primary deliverable is demonstrable, scalable enterprise value that can withstand rigorous financial and commercial due diligence.

1. Architecting the Investment Thesis

The Agency translates raw operational performance into a sophisticated, forward-looking investment thesis. Key deliverables include:

Differentiation Strategy: Defining the unique, sustainable competitive advantage (the "moat").

Market Segmentation: Validating market size and headroom with granular data to support significant growth projections.

This alignment of operational facts with strategic narrative is paramount. As Bain & Company asserts regarding the foundational elements of M&A:

"An effective equity story must be grounded in real actions that create tangible long-term value."

2. Systemizing Predictable Revenue

Buyers pay the highest premiums for predictability and repeatability. The Agency institutes the systems that de-risk future revenue streams:

Financial Marketing Metrics: They establish and optimize the fundamental financial equations of growth, rigorously documenting CAC, LTV, and retention/churn metrics. These data points are the financial foundations of a premium valuation multiple.

Go-to-Market (GTM) Alignment: Creating a codified, repeatable "Sales Playbook" that aligns marketing lead generation with sales conversion, proving growth is independent of individual heroic efforts.

Kuno Creative's analysis underscores this vital role:

"Marketing sits at the front line of that engine. How it performs can influence not only enterprise value, but whether a deal happens at all."

3. Proactive Risk Mitigation

By systematically addressing structural vulnerabilities prior to the process, the Agency preemptively eliminates common valuation deductions. This includes customer diversification and building a defensible brand equity that proves the business's resilience beyond key personnel.The Timeline to Value Maximization

The 1nessAgency.com Perspective

Maximizing shareholder value is a strategic exercise, not merely a transactional one. We advocate for a disciplined, systematic approach to value engineering before engaging the sale process. Partnering with a specialized Agency first ensures your company enters the market at its maximum attainable value.

A refined, data-backed strategy can inject $10–$50M+ into your valuation before you ever issue a Confidential Information Memorandum (CIM). The strategic choice is not whether to employ marketing expertise, but how much enterprise value you are willing to forfeit by delaying it.

Actionable Takeaway: Assess the predictability of your current GTM strategy. Is your growth repeatable and demonstrably scalable? If not, your valuation is under-optimized.

Would you like to schedule a diagnostic audit of your current Go-to-Market strategy to quantify potential value leakage?